Summer means longer days and more traveling, which can also lead to an increased risk of getting into costly accidents and more visits to the emergency room. Raymond Nelson Insurance wants to make sure you have the appropriate insurance this season

Here’s a list of potential summer risks and how to reduce them.

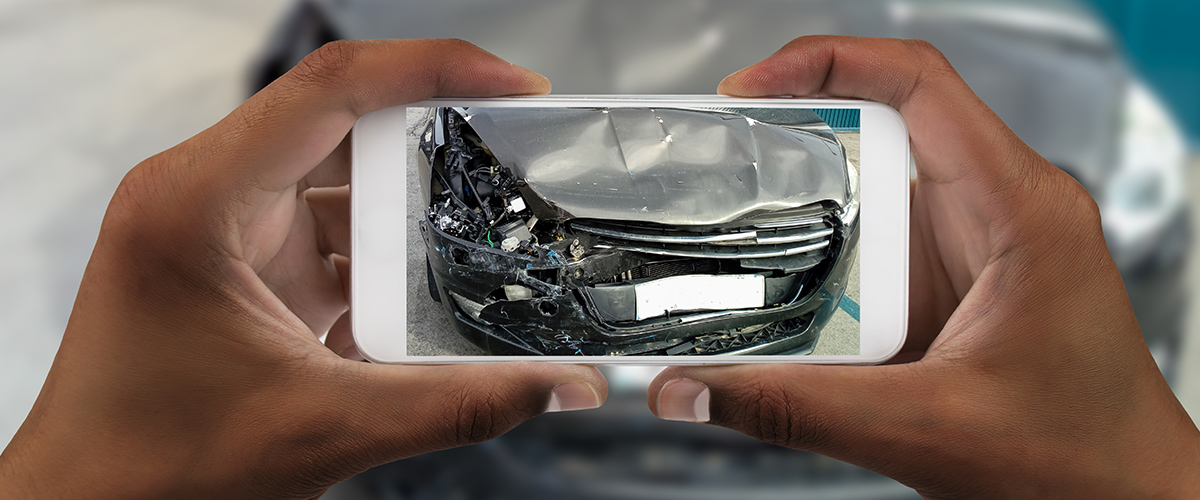

Road Trips

- With more cars on the road, the summer months are the most dangerous times of the year.

- What do you do if you get into an accident while driving a rental car?

- Your personal car insurance typically includes driving a rental car.

- If you don’t have collision coverage on your auto policy, the credit card you use to rent the car may offer coverage.

- If you don’t have either, you should buy at least the liability insurance provided by the rental company.

Swimming Pools

- Last summer more than 160 people drowned in pools with 70% of them being children.

- What if some gets injured or drown in your pool?

- Your liability coverage on your homeowner’s policy should be at least $300,000 to $500,00.

- The Insurance Information Institute recommends taking measures to prevent accidents, such as building a fence around the pool and making sure children never swim unattended.

- Use a pool cover and install alarms that alert you if someone enters the water.

- Learn basic water rescue techniques.

- It’s always good to speak with Raymond Nelson Insurance about your homeowner’s insurance to make sure you’re covered for accidents.

Boats

- According to the U.S. Coast Guard, there were nearly 4,300 accidents on recreational boats, causing about $46 million in damage last year alone.

- Small boats such as kayaks and canoes may be covered under your homeowner’s insurance.

- Large watercraft or personal watercrafts such as jet skis typically need a separate policy.

- Speak with Raymond Nelson Insurance about your boat insurance to make sure you’re covered.

Speak with your Raymond Nelson Insurance agent to make sure you have the proper coverage for all your insurance needs.

At Raymond Nelson Insurance, we go the extra mile to find you the coverage that best protects what matters most, the business you’ve built, and the people you love. We always take the time to get to know each client and serve their best interests. Give us a call today at (270)885-1800 or contact us online for more information.